How to cite: Gambla, Michael T. “Future Options for Urology Practice Ownership” January 27, 2018. Accessed [date today]. https://dev.grandroundsinurology.com/Future-Options-for-Urology-Practice-Ownership/

Summary:

Michael T. Gambla, MD, explains how to navigate the landscape of hospital partnerships and purchases, private equity partnerships and transactions, and large groups consolidating for expansion in the realm of urology.

Future Options for Urology Practice Ownership – Transcript

Click on slide to expand

Future Options For Urology Practice Ownership

As Neal said, this has really become sort of an interesting time for urology, particularly the large, independent groups. It’s a time somewhat of survival, change, and that has somewhat lead to a lot of other large groups, be it equity groups, as Neal said, aggregate groups, and I’ll describe what these different types are, as well as hospitals sort of seeking opportunity within urology, and we’re going to take a look at what are some of the drivers for that, and then we’re going to take a look at each sort of entity and how they might play a role.

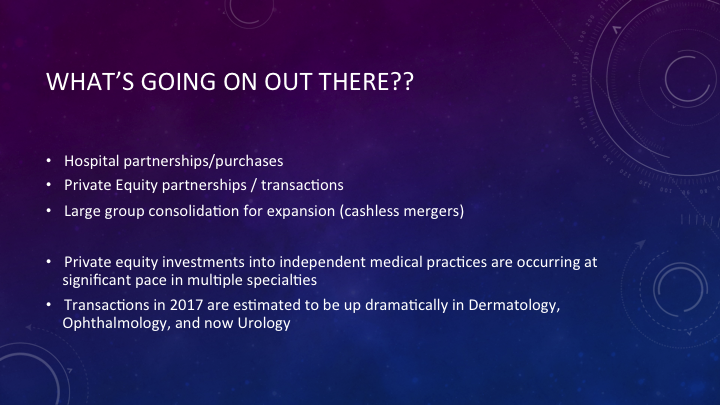

What’s going on out there??

So really what’s going on out there? Five years ago there wasn’t any mention of private equity in urology. We were just focused on LUGPA, independent practices, and maybe aggregating our own practices, merging the partners down the street. There was no real cash involved. It was trying to get the guy that we hated before to come join us because we needed to do a bigger project. That’s what that was about. It was about putting old legacy practices away. Now, we have all kinds of new entries into the market. So, we have hospital partnerships, somewhat what Evan was talking about, where maybe it’s a PSA agreement. We’re trying to figure out what’s the right type of a partnership there. Sometimes, it’s an outright purchase. There have been urology groups where they have been purchased by the hospital and integrated right in. And you’ve got private equity partnerships and transactions taking place. There’s been one that has already taken place, and there are a number that are on the docket for this year and into next year. They take some time to do, but we’ll explore that a little bit.

Just as a kind of FYI, the private equity investment, particularly into the independent medical practices, are occurring at an incredibly significant pace, particularly in urology, dermatology, ophthalmology and radiology. So, they know this space needs help. They know these groups have maximized their size, and so they are now coming in and saying, “How can we help you?” So, don’t be surprised if you’re running your group and you get calls, random calls, from private equity guys in New York saying, “Hey, can I talk to you about an opportunity?” Because that’s what’s happening in the space, and again you’ll see that in these multiple specialties, and I’ll show you what’s happening.

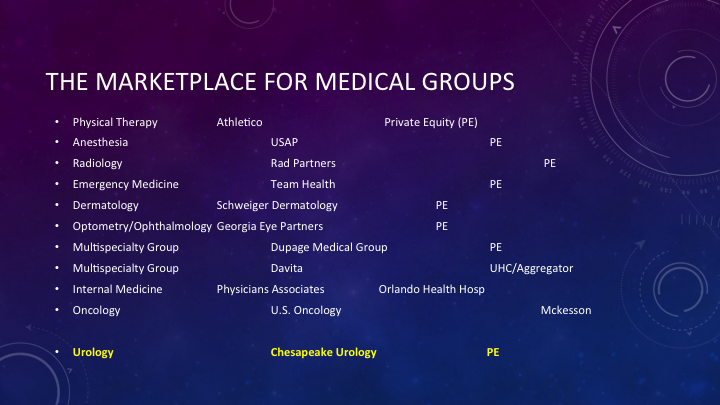

The Marketplace for Medical Groups

So, this is just a list of different transactions that have occurred. There are far more than this to list. I just thought this was a nice smattering, because it really just shows different areas. I mean, you’ve got anesthesia, USAP, that is US Anesthesia Partners. That group was a group that was purchased initially in the 100, 200 million size. It’s now over a billion dollars. It’s huge. So, these groups have increased in size. Rad Partners is a very, very large radiology partnership, and there’s just a recent transaction that took place for another partnerships that’s over 100 radiology partners. If you look through this, Schweiger Dermatology is, to my knowledge, the largest dermatology clinic throughout New York. It’s my understanding that they’ve grown in size to some 20 offices, and again, bringing in dermatologists to—and again all private equity backed, so they take the core of what we’ve built over the last 5-10 years in LUGPA, these independent groups, and then they accelerate the process. And obviously, the one in gold here is in urology, Chesapeake Urology last June, doing their transaction in private equity. Then, from this point up to now, Chesapeake has added additional groups. So, they have been accelerated, again, through the process that we’ve seen with these other types of entities, where they’re starting to grow their group beyond their initial base.

Drivers for Ownership in Urology Practice

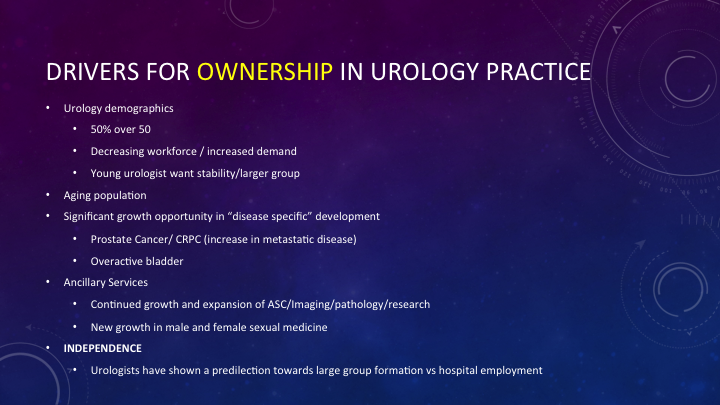

So, what are the real drivers for this ownership in urology practice? Why do they want to come in? Well, they see the demographics. They know there’s a decreasing workforce and more increased demand. Some 10,000 people are turning 65 and going on Medicare every day, just a huge number of patients who are going to come into our arena, and they know that’s there. The young urologists, on the other hand, are looking for stability, and that stability can only come through a large group, or they go to the hospital. No one is hanging a shingle today. So, the cost of operation of doing that is far beyond what we can experience any more. So, they have to have a choice, and that choice is either the large group or hospital-based environment. We know the aging population. We talked about that.

The private equity, and even the hospital in the aggregate, or it’s these different types of entities that come into the space, they understand that there is a significant growth opportunity in exploring clinical pathways with very disease-specific development, particularly a lot of talk in this conference about CRPC, metastatic disease, the new drugs that are coming through, what is the best opportunity. Well there’s also financial basis behind all of that, and so they understand that. And they know this business is not well explored, so a lot of these disease states have not been fully baked out to where programs are, as Evan was alluding, with the stents where all the group follows one pathway, and that process, when driven the right way, can create economic gain for the group, obviously for the investor, but it also can be good for the patient. So, they do look for synergy. It’s not just financially based motives. They really want to create a product, if you will, that benefits patient care because they are not going to, as Evan alluded to in his talk, there’s quality measures that are out there, and so if you’re not hitting quality measures, it doesn’t matter if you can make money or not, because eventually that will be gone.

Other opportunities—I see they want to accelerate the ancillaries, they see new growth in male and female sexual medicine, which has not really been well explored in urology. It is now becoming more explored. So, that is a new opportunity, and truthfully, having talked to multiple different types of groups that come into urology, looking for some kind of partnership, the truth is they think that urologists have always shown a predilection for large group formation. And we as a generalized group through LUGPA have kind of formed the sense that independence is what we have been seeking. And so, they’re going to try and preserve it.

Drivers for Sale/Partner in Urology Practice

So, what are the real drivers for us as urologists in a group practice to sell? Why would we want to do this? We’ve built these great establishments. We’ve come up with our pathways. Why do we want another partner? And we always know the other partner is the unknown partner. We don’t know what they’re going to do. For most of us, it was fear of the hospital partner and how they’re going to react. Now, we may have a financial partner, but the truth is these practices have become very complex micro cap businesses, 50 million, 80 million, 100 million dollars of revenue, and the truth is we’re running it with a number of urologists, guys who may never have an MBA, have never been trained in business, and now we have this monster of a machine, and maybe it’s not being run so well. So, the problem is, we start getting into different issues like increased overhead, and how do we manage that? More compliance and regulatory issues are coming up. We had to hire a security officer, a compliance officer. That’s all non-producing personnel on the list that increases your overhead, but it’s a necessity when you get to a certain size, because you become more visible to everybody.

A lot of increased IT cost. It’s far more complex. The platforms are narrowing down as to what you can choose for EMR, whether you’re going to go to Epic, or Serner, or Athena. I mean, these are big, expensive platforms to implement. Carrying cost on drugs, supplies, equipment, we know that if your IMRT machine breaks down, that’s a huge cost. Our CT broke down, and it was an uncovered cost, $50,000 right to the group, just right to the bottom line. Even though we have a contracted agreement, that particular agreement was an electrical issue. The doctors just ate it, that was it.

The billing process, think about it, now we have pre-certs for everything, and for every drug, particularly in the space we’re talking about at this conference. These are expensive drugs. Each one has to be thoroughly—go through a pre-cert process to make sure that the payment is going to be there, because we can’t afford to take the hit, which is actually why, early on in this particular arena, a lot of these drugs didn’t get a lot of momentum. There was a lot of concern whether the groups could afford to do this.

And then, finally perhaps the biggest issue I have seen, is the skilled personnel. We’re building very, very large companies, corporations, however you want to call it. Do we have the right personnel at the top, a real CEO who understands our business, a CFO, a chief information officer? Do we have a data analyst? To be able to succeed in the new environment that’s being created for us by the government we need to have these types of people running these businesses. Doing it the old way we’ve always done it won’t survive.

One of the interesting things I’ve learned, having grown my group for seven years, is that physicians don’t typically reinvest in growth. Right? At the end of the year there’s not this, hey, let’s put 20% back in the pot and build this new center. No, it’s where’s my check? Did I get paid? Where’s my bonus? How come it didn’t come? You said the fifth. It’s not here. The phone calls come in. So, the truth is, we don’t typically, as surgeons and as urologists, think about, hey, how do we grow the business here? That’s not our mindset, and you know what we’re focused on medicine, we’re focused on better care, and that’s what we should be doing, which is why we need skilled personnel.

Drivers For Sale/Partner In Urology Practice #2

The other issue is we don’t have time. Most physicians at least in leadership roles are spending an increased amount of time in administration, and that takes away from good patient care and from them thinking about what’s right for patients down the stretch, or looking at new alternatives in the medical space and device space so that we can have improved outcomes. The businesses are complex, as I showed you on that prior, and then the decrease in quality of life work balance. I mean, you look at the young guys coming out, and they want to go to the hospital. They figure, at the hospital, they’ll see 25 patients a day, they’re out of there by four, they’re not going to have the responsibility of any administrative things at all, and they’re okay just taking a salary. We’ve tried to hire a number of candidates this year. It’s very difficult to compete with the hospitals. They get very large salaries up front. They get enticed by that, and they get subject to some RVU bonus, which, by the way, is subject to the hospital. One year it might be $50 an RVU. The next year it could be 45. It just depends on what they want to do. So, you’re completely subject to a hospital ruling. But, you look at this, and you think, wow, otherwise you’re running all of this. So, they get away from all that, and these are the issues we face.

Goals of Partnership: Hospital

So let’s go over some of these different entities. Goal of partnership of the hospital—in the hospital, let’s start on the physician side. It’s really a one-time sale of your practice. Right? You sell it, and you become employed. Typically, they will give you a three to five-year contract, so you have some stability. There’s minimal admin responsibility, maybe one person kind of gets elected to be sort of the chair of urology or the admin person for the group that gets pulled in. The hospital may already have a number of urologists, and they’re seeking a little bit more leadership there, and then it’s a fix salary and RVU bonus, and a lot of guys are comfortable with that. They just want to know, “I’m making X amount this year and for the next five years.” What’s the down side? Absolute loss of control. You are completely subject to whatever the hospital says. No growth strategy. Hospitals typically don’t grow urology markets. That’s not their basis. It’s not their focus, and we make a small percent of what the hospital does. So to Evan‘s point, they may worry about catheter associated UTIs and hospital-based things that they’re going to get dinged for, but they’re not necessarily looking to add the next new innovative device to urology and again a fixed salary. So, you really don’t have a lot of up side growth if a new entity comes, or a new technology comes that could potentially produce revenue.

The hospital is all about network and regional control. They can give you patient volume, and that’s what they want. And you bring that to them when you sell. It decreases the competition. You’re not fighting the hospital. You’ve joined them. They will drive their hospital plan or health plan if they have it, and to some extent because they are usually contracted with everything, you don’t have to worry about contracting, so for them this is an easy goal. They can make more money off of you. It’s increased revenue. You’re a fixed cost to them. They know how much they are going to pay you for the most part. They know what the average urologist makes. If you happen to be a big worker bee, they make money off of that. So they know that is part of the deal for them.

Finally, they are going to maximize every dollar they can make off you through their hospital outpatient surgical centers, where they get a better rate than you would in your surgical center. They know the ancillary reimbursement through a hospital contract is far better than you and I can get in our large practices, so they have a definite up side, and they know, as Evan mentioned in his, they know their margins. They know exactly how much they are going to probably make off of every single person they bring in. So, there’s an absolute win for them in doing this.

Now, let’s talk about what’s a physician aggregator. Physician aggregators are companies like McKesson, 21st Century. These are groups that are not necessarily medically based, in that they manage groups, but they’ve had other entities that they’ve come up through the ranks with that then allow groups to come in. So, in McKesson’s case, they do pharmaceuticals, but they’ve realized they could build a group around that. And guess what that’s US Oncology, over 1000 oncologists. Of course, they get all of their distribution through McKesson. So, there was a very synergistic play there. 21st Century had a very similar model. The urologists were building radiation therapy machines. 21st Century was there with their model of how they do the radiation oncology. The synergy comes together. So, it wasn’t necessarily based on sort of private equity financial motive. It was more because there was synergy.

Goals of partnership: Physician Aggregator

If you look at this in this case, the physician—typically these joint ventures, it’s 51% sale of the practice, or perhaps just sale of your ancillary. You may not sell the practice, but you immediately sell off your ancillaries to them in some sale. Typically, it’s a little bit more blended. It will be a salary, but there will be a growth model, because they want to growth the business. It’s some blended clinical administrative duties. They don’t necessarily want to take over the entire operations of the practice. They want you to be a participant, because it’s a 50/50 type model. Typically, they will take away all of the back office responsibilities. That will not be on you any longer. They want to manage it better than you do. That is the crux of that, how it works. You’ll have influence on your practice direction, but not completely. You’ve given up some control, and so they will ask for opinions, and they’ll see if it works out. They may or may not—a great example of that is just—we have McKesson as a partner for our radiation therapy services. We wanted to institute Xofigo. They looked at it. We thought it was great. Clinically, it made sense. We thought it was great for patients. They didn’t want to be a part of it. So, we had to do it on our own, even though we have a joint venture with them on our radiation therapy, we had to build our own Xofigo lab. So, you can have little disagreements like that along the way.

It’s definitely going to be more of a corporate environment. For them, they want to build very large group design. They are not interested in 30-man and 50-man groups. They’re interested in building 200, 800, very, very large groups. That’s how they typically work, because that’s where the benefit comes to them. They want to drive the operations lower. There’s some administrative fees along with that so they can collect a little bit of revenue. They’ll control your spending, and so that’s where they’ll make some money, and typically they will try to get better contracting through their products and services. Again, they’re usually these big behemoths that can come in and have very, very large leverage.

Goals of Partnership: Private Equity

All right so let’s talk about private equity. That’s probably the closest thing to trying to keep your practice independent. So, for the physician, it’s the sale of the practice based on a number. So, typically, you’ll take a decline in your salary. So, let’s say you were to decrease your salary by $100,000, and the multiple you get is 10, you get a million dollars, but next year your salary is minus $100,000. So, if you were making 300, you’re now making 200. Then, the hope is that through their efforts, financially and management wise, you’ll grow the business, and obviously through growth of the business, you’ll recapture that as part of your income. They are very much aligned with you, as they don’t take any money off the table until they sell the company. So, there is no management fee. They don’t have any kind of administrative fees. You manage your practice alongside with them. You keep your board. You keep everything as far as controlling. They’ll interject where appropriate. They’ll help you do pro formas. They’ll help you do management, but they don’t get any money until they sell the company.

Now, there will be a sale of the company, so you have to understand your company will be sold from one firm to another firm five years later, and you may not know who that partner is. And the truth is, unless you put it in a contract, it could be a hospital, it could be an aggregator, so you have to be careful about when you’re doing contracting, what you will agree to for that second bite. However, when you do that second bite, you will also get another large distribution. So, because you’ve grown the company and the company will be sold at a certain multiple, you’ll also benefit from that. So this type of model has the opportunity to give you income or what we’ll call take some money off the table, but you have to be ready to engage, and this is a very grueling process in getting this done. On the private equity side, they want a platform or an add-on practice. We’ll describe what those are in a minute. They will explain their ancillary services, ASC, imaging, etc. They are going to do a practice management analysis improvement. They’re going to do a business operation data analytics. They’re going to come in, and they’re going to look at your operation. And they’re going to refine most part of it because the truth is we don’t manage them all that well. So they’re going to find ways to tweak things, and basically they know there’s a lot of margin left on the table that we don’t really capture, and they are going to capture that for you. Again, depending on the type of ownership you have with them, you will benefit in that up side. So a lot of times you will benefit in how they save you money, because they have to be aligned. If you’re not working, they’re not making.

They’ll consolidate any redundant services, and then again, you’ll sell your practice within a time frame of three to five years. That’s usually what it takes to turn these—I don’t want to say turn the groups around, but to refine them and get them ready for sale. I will say, however, they also will engage in new therapies. So, if they see a therapy that is the opportunity to improve patient care and have a financial reward associated with it, they’re going to promote that. So, if you weren’t going to capitalize something that you really wanted to do because the physicians have to capitalize it themselves, this is an opportunity to do things like that.

Who are you?

Who are you? Platform groups are large groups. They have everything intact. They’re very well-oiled machines. They’re typically the size of 25, 30-man groups. They have geographic presence. They’re culturally integrated. They function as one group. Add-ons, much smaller groups, typically an office manager. A lot of services are outsourced. They may have some ancillaries. They don’t have the total presence in the area. So, most private equity groups will start with a platform group and then bring add-ons or bolt-ons. What are the four basic objectives for private equity to invest?

4 Basic Objectives for PE to Invest in Urology Groups

They want to do a consolidation. They want to have diversification so they want to expand you so that if one area or market goes down the other area can be supported. They want to unlock all of the potential of your ancillary services, and they want to make sure that the administrative services, the back office operations are consolidated efficient and best practice.

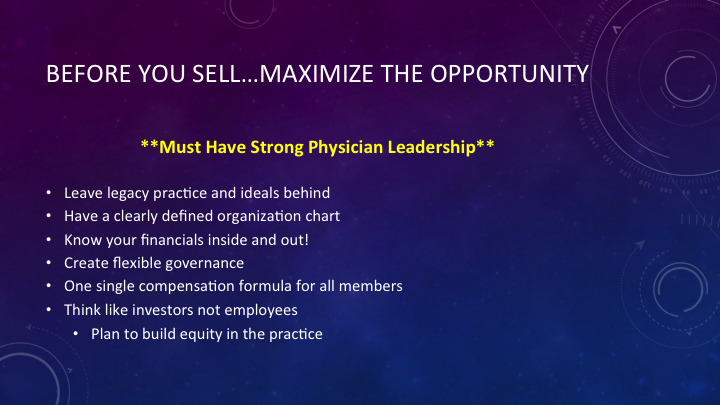

Before you sell…maximize the opportunity

So, before you sell, maximize your opportunity. So, if you decide to engage in this process, which I have been through and still continue to feel like I’m going through, you need to understand that this is a very long process. It is typically a 6 to 12-month process to do this. You have to have strong physician leadership, and you have to have strong group leadership where they believe that you’re going in the right direction. As Evan said, herding cats can be difficult for getting them on a stent. Herding cats for this is a long, enduring process. You really have to be motivated to say this is where we want to go. The legacy practices that you’ve had when you all combine have to go away. They won’t tolerate cultural lack of integration. You have to have a defined organization chart within your system as to how the CEO operates, and the COO, and everyone underneath the managers. You have to know your financials inside and out, because they’re going to know your financials inside and out. Create flexible governance, and understand governance really well, because they’re going to ask for it. They’re going to want to know how your board manages things, who manages things, who’s appointed in this area or that area for committees.

Typically, they are going to want the entire group on one compensation formula. That may be what some groups do right now, other groups tend to have multiple different compensation formulas. That makes it difficult for them to understand, and so they will bring you to one. And they really want you to one, and they really want you to think like an investor. So when you’re aligned with a private equity group, you are an investor in your own company. So if you invest in Coke, you don’t drink Pepsi, and that’s how they see it. So, if you are going to invest in this group, they expect that you are going to do everything for this group and that you’re not going to take patients to some outside surgical center because that goes against their model. So, you really have to think like an investor.

And obviously they want you to build equity in the practice because they are aligned with you. They want to build it alongside.

ABOUT THE AUTHOR

Dr. Gambla is a urologist with the Central Ohio Urology Group and is affiliated with Riverside Methodist Hospital in Columbus. He received his medical degree from Rush Presbyterian University Medical College in 1996. He completed his internship and residencies in General Surgery and Urology at Ohio State University. In his practice, Dr. Gambla specializes in a variety of urologic disorders, including prostate disease and female urology.